Austria’s tax system increasingly geared to consumption

Facebook, Apple, Google and many other digital companies that do business worldwide have set up their European offices in Ireland in order to benefit from the comparably low corporate taxes there. At the same time, they are able to generate high profits from their activities elsewhere without having any physical presence in these countries. The international community has now responded to this situation by introducing rules for a global minimum tax regime. 135 countries want to enforce a tax on profits of at least 15 percent, regardless of where the company is based. As a next step, the place where the profits are made is to become relevant. Taxes are to be levied where the digital services are used and the revenues are earned. There is still a long way to go, however, before this intention will be translated into reality.

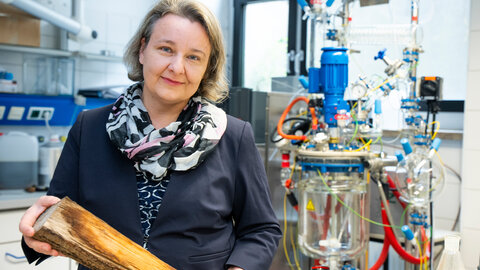

In the global digital economy, this new focus on the place of consumption would constitute a paradigm shift. National tax systems, on the other hand, are used to considering consumption as an accepted taxation factor. “All modern tax systems are based on mixed systems that link their taxes to three different factors: income, assets and consumption,” explains Anna-Maria Anderwald, who investigates trends in tax systems at the Institute of Financial Law at the Karl Franzens University in Graz. In the FWF-funded project “From Income to Consumption,” she is analyzing the development of the domestic tax system over the past 30 years. “Many things point to the fact that the tax system in Austria is becoming increasingly focused on consumption,” Anderwald notes. Her research project is one of the first to analyze the development of the tax system as a whole and not just focus on individual tax types.

Capital gains tax and private foundations

Anderwald chose a time horizon of 30 years because heated discussions arose in Germany and Austria among finance experts on the taxation of consumption in the 1980s and 1990s. At that time, a number of economists championed a more pronounced shift towards consumption-based taxes. The early introduction of the capital gains tax in 1993 and the almost simultaneous adoption of the Austrian Private Foundation Act that granted tax privileges seemed to confirm Austria’s path in this direction. Both innovations are geared to a focus on consumption.

The following decades saw a pronounced decline in wealth taxation and the abolition of inheritance and gift tax. On the other hand, the fiscal regime provides many advantageous regulations for investments. Capital income enjoys lower taxes than labor income – a situation that favors savings and thereby provides leeway for spending. Lower corporate taxes have the same thrust. “Shifts such as these in the taxation mix indicate an approach that favors consumption,” Anderwald concludes.

Many states show this tendency: their tax systems focus on consumption while at the same time paying less attention to income. In the long run, this development might be linked to a change in societal values. “The tax system always holds a mirror up to society. It shows, for instance, the value a society attributes to property, family or children,” Anderwald explains. “In the fiscal system we also find a development that social researchers have been observing for a long time – the fact that we are shifting from an income-based society to a consumption-based society. Identity is no longer forged mainly by income, but consumption.” It is not your job that tells others who you are, but what you spend your money on.

Competing for capital and investments

The tangible motivation for fiscal transformation has less to do with long-term social developments, however, than with immediate political considerations – another aspect that Anderson is investigating. Many tax rules aim at attracting wealth to Austria and keeping it here. “The process seems to be informed less by fundamental financial science considerations than by the constraints of international tax competition,” Anderwald emphasizes. “Consumption is simply less mobile than capital, which makes it a more attractive target for the fiscal regime.”

In social terms, however, catering to these constraints has serious consequences. “The shifts lead to a tax regime that favors the rich,” Anderwald explains. “The distribution of wealth in Austria already shows drastic misalignment – also in an international comparison. A few rich people hold the lion’s share of the capital.” In the context of global minimum taxation, there are now long-term considerations regarding the adjustment of corporate taxes. The corporate tax rate is no longer to be determined exclusively by the physical location of a company, but also by the places where its products are consumed. In this way, the system could counteract the tax competition between countries that is to the detriment of a majority of citizens.

Personal details

Anna-Maria Anderwald studied law at the Karl-Franzens University in Graz and at Columbia Law School. After passing the Austrian bar exam, she returned to the University of Graz as a postdoc research assistant, and she is now teaching and conducting research at the Institute of Financial Law. Anderwald’s project “From income to consumption” is being awarded EUR 243,000 by the Austrian Science Fund FWF under its Hertha-Firnberg Program.

Publications

Anderwald, A.: Besteuerung von Alterseinkünften als konsumorientiertes Element, in: taxlex 2022/05 (155 pp)

Anderwald, A.: Rising Inequality in Western Tax Systems: Austria as an Example of the Transformation of Income-Based Taxation to Consumption-Based Taxation, in: Bulletin for International Taxation 75/2021

Anderwald, A.: Wie die „schleichende” Konsumorientierung unseres Steuersystems zum Auseinanderdriften der Vermögensverhältnisse führt – Können Vermögensteuern Abhilfe schaffen?, in: ÖStZ 2020, (517 pp)