A workhorse for severe crises?

These days, the corona crisis is also a frequent topic of discussions and reflections at the Institute for Advanced Studies (IHS) in Vienna, as economist Michael Reiter reports. In economic science, the de facto work-ban designed to contain infection rates is modelled as a “technology shock” of a dimension comparable, if at all, only to the oil-price shock 40 years ago. At that time, oil and oil products required for production became instantly more expensive, thus impairing productivity. In a similar way, the coronavirus is causing a supply-side crisis, as Reiter puts it, and monetary policy can contribute only to a very limited extent to its solution. The main brunt of crisis management lies on the shoulders of fiscal policy-makers. Expressed in very simple terms, states are called upon to incur debt in order to prevent high unemployment and to protect companies and households from insolvency.

Shocks shift the focus

In a project supported by the Austrian Science Fund FWF, Michael Reiter is working with a doctoral student on modelling the most recent global shock: the financial crisis that started in 2009. Their focus is on the interaction between the banking and production sectors, on the way risk-balancing works between the two sectors and on how monetary policy can ensure stability. Regardless of whether a crisis is rooted in the banking or the production sector, it can lead to mutually reinforcing negative effects in both sectors. What do the financial crisis of 2009 and the corona crisis of 2020 have in common? There is a need for a crisis to occur before experts turn their attention to the issue and serious reforms are implemented. Even before 2009, individual economists sounded warnings about the poor capital adequacy of the banking sector in the US and Europe. Conventional monetary policy, on the other hand, perceived its task as regulating demand by means of adjusting the level of interest rates. “The focus has shifted since then: the financial stability of the banking sector has become more important in order to ensure that lending to the production sector is guaranteed even in a crisis. To date, this interaction has been mapped in macroeconomics with models that bear little resemblance to reality,” explains Michael Reiter. The aim of the project is to create a model that is closer to reality but not too complicated.

Who bears the default risk?

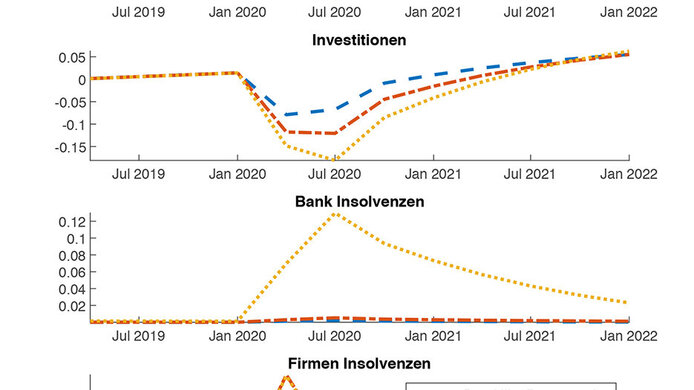

Companies borrow money from banks for investments. The type of loan contract, long-term or short-term, affects the risk of default. In reality, companies need long-term loan contracts to finance their investments. During normal economic fluctuations, nothing much happens in the interaction between banks and companies. As soon as companies run into payment difficulties, however, banks bear a higher risk of default in the case of long-term loan agreements. If the banking sector is poorly capitalized – as was the case before the 2009 financial crisis – it is harder for banks to mitigate this risk. “We have devised a model that plausibly explains why strong non-linear effects occur,” explains Reiter. If major shocks occur, the banking sector has a very heavy burden to bear, especially in case of long-term loan agreements. This results in fewer loans being granted, which in turn has a backlash on the production sector.

Historical data series can be readily explained

A model with empirical relevance must be tested on the basis of historical data, and it must be able to explain such data qualitatively and quantitatively. In order to do this, Michael Reiter and his collaborator Leopold Zessner-Spitzenberg rely on aggregated US banking statistics data from 1988 to 2015. The two economists are particularly interested in the trade-off between the benefits and the potential cost of additional equity. Reiter's conclusion: the transition periods are difficult because more equity is associated with higher costs for the banks. The model shows that the regulatory requirements of increasing equity are well tolerated if longer transition periods are granted. Michael Reiter believes that the new model could be a “workhorse” that lends itself for many applications: “With this model, we have created a good building block for modelling cooperation between the financial system and the real economy. This means there are many possible applications.” Before 2009, nobody listened to Cassandra. After the financial crisis, capital requirements for banks were regulated and increased. This has prepared them well for the current situation, because the banking system is now more likely to maintain its liquidity in the face of defaults.

Personal details Michael Reiter is head of the research group “Macroeconomics and Economic Policy” at the Institute for Advanced Studies (IHS) in Vienna, and a faculty member of the Vienna Graduate School of Economics (VGSE). Before joining IHS in 2007, he was an associate professor at the University of Pompeu Fabra in Barcelona.

Publications & working papers